1. Sustainable corporate governance // 2. Business model and business performance // 3. Social affairs // 4. Environment

1.3 Strategic events and developments

Strategic target achievement

SQS works with the Balanced Scorecard as an instrument for managing and evaluating our development. We have defined key performance indicators (KPIs) for each of the four target areas - finance, clients, processes and employees, learning and development. The picture that can be drawn for the 2023 financial year based on these KPIs is overall positive.

Finance

The key financial figures paint a mixed picture. On the one hand, sales increased more than budgeted to a new record level. This means that the SQS offering is in line with the market and continues to meet growing demand. On the other hand, costs rose even more sharply, causing the operating result and margin to fall. The two most important extraordinary cost drivers were the development of MS Dynamics 365 as the new system for enterprise resource planning (ERP) and customer relationship management (CRM) as well as the regulatory environment. The requirements of state accreditation and private authorisation bodies are leading to an ever-increasing administrative burden. In addition, in the name of impartiality and high qualification requirements, these bodies are restricting the opportunities to deploy auditors in a wide range of scopes. This reduces economies of scale, intensifies the shortage of skilled labour and thus drives up costs.

|

FINANCE |

Target 2024 |

Actual 2024 |

|

|

F1 |

Turnover |

CHF 49 800 000 |

CHF 50 652 284 |

|

F2 |

EBITDA (Operating result I) |

CHF 1 720 000 |

CHF 1 553 429 |

|

F3 |

EBITDA-Margin (before AGBR-contribution) |

3.4 % |

3.1 % |

Clients and markets

The results in the «Clients and Markets» area were pleasing. Customer satisfaction once again improved slightly at a high level. We also achieved our ambitious acquisition targets. SQS's services are therefore in high demand - both for the main standards ISO 9001, ISO 14001 and ISO 45001 as well as for branch-specific norms and standards. Thanks to 715 new customers, the already broad customer base was expanded even further. The fact that more than every second quotation issued led to a contract is also evidence of professional and efficient account management. On the other hand, cross-selling business lost momentum compared to previous years.

|

CLIENTS |

Target 2024 |

Actual 2024 |

|

|

K1 |

Customer satisfaction (auditors) |

4.6 |

4.58 |

|

K2 |

Acquisition targets

|

850 570 280 |

1046 715 237 |

|

K3 |

Hit rate (Contracts in % of offers submitted)

|

60% |

49% |

Processes

The SQS process landscape proved its worth in the reporting year. The QM Pilot process management system contains all of our specification documentation and reflects our day-to-day working methods and processes. The processes have also been continuously reviewed on the basis of a new high-level process organisation and as part of the D365 development and adapted where necessary. Both the internal audits and those conducted by the accreditation and other authorisation bodies led to pleasing results. The number of nonconformities could be further reduced from an already low level. The fact that there was not a single appeal against our certification decisions is also evidence of functioning processes and competent and conscientious employees. Only the productivity of the auditors was again slightly below target.

|

PROCESSES |

Target 2022 - 2024 |

Actual 2024 |

|

|

Productivity A fulltime |

AP3 (Audit- and travelling time per auditor and month; average): > 100 |

95 |

|

|

P2 |

Technical compliance |

Maintain authorisations, prevent suspensions and sanctions |

no suspension |

|

P3 |

Organisational compliance |

Risik mitigation in a dynamic legal environment |

ok |

Employees

As part of the creation of the «Organisational Development and Human Resources» department (see explanations under 1.3.2 Organisation and environment), the key performance indicators were also adjusted in 2024. The qualitative indicators, which are evaluated every two years (last time in 2023 and next time in 2025) by means of the employee survey, remain relevant. Starting in 2025, we will consider unused holiday credits, days absent due to illness and employee overtime as additional key figures. The year 2024 will serve as the base year.

|

EMPLOYEES, LEARNING & DEVELOPMENT |

Base year 2024 |

|

|

M1-M5 |

Employee commitment and satisfaction (MA) |

The Employee Survey is conducted every two years. The aim is to improve the results from 2023 to 2025 in all areas. |

|

M6 |

Holiday credits per 31.12. |

The average open holiday credits per employee in 2024 were 7.35 days. The target for 2025 is to reduce this figure. |

|

M7 |

Days absent due to illness |

The total number of days absent due to illness in 2024 was 991.5 (absences of less than 30 days) resp. 469.1 (absences of more than 30 days, i.e. long-term absences). The target for 2025 is to reduce these figures. |

|

M8 |

Overtime per 31.12 |

In 2024, the number of employees at the head office who exceeded the limit of 60 hours of overtime was 24. The number of auditors who exceeded the limit of 170 hours was 28. The target for 2025 is to reduce these figures. |

Organisation and Environment

The reporting year was characterised by groundbreaking measures for organisational development and the positioning of the SQS as a player in the Swiss SME economy. The first three sections are dedicated to these topics. The fourth section - which can also be opened as an accordion - explains other strategically relevant events and developments.

In the decades following its foundation in 1983, SQS grew strongly and organically, with the decentralised organisation allowing close proximity to the market and customers. However, this organisational form and development also resulted in disadvantages. In many respects, SQS reached a critical size that made it necessary to adapt structures and processes. It resembled a tree whose trunk was becoming increasingly slender in relation to the growing branches with their numerous heavy fruits. Several factors within and outside the SQS increased the need for organisational action:

-

the growth of the market for certifications according to ISO management system standards (the core business in strategic business unit 1) has flattened out after the boom in the 1990s and 2000s;

-

the growth of the market for certifications according to special standards (for example in the automotive, food, aviation or medical technology sectors) requires specialisation, which limits the flexible deployment of auditors in various areas and triggers (additional) cost and efficiency pressure;

-

the specialisation and demographic development of the SQS staff have intensified the general shortage of skilled workers, which results in greater demands on personnel recruitment, support and development;

-

the growing requirements on the part of the accreditation- and authorisation bodies have led to an increased administrative burden;

-

the market for the assessment and verification of sustainable corporate governance (strategic business unit 2) is at an early stage of development, in which SQS must position and promote itself as a service provider to new target groups;

-

the megatrend of digitalisation requires that organisations undergo fundamental further development with adjustments in all areas.

Measures for organisational development

The Executive Management and the Board had already responded to the need for action arising from the context described above before the reporting year. In 2024, however, several ground-breaking measures were planned and implemented, which are reflected in a so-called future organisation and a new organisational chart:

Establishment of the department «Organisational Development and Human Resources»: This department reports directly to the CEO. Its mission is to ensure that SQS is and remains an attractive employer that can acquire, develop and retain the necessary human resources.

Strengthening the department «Finance, Controlling and Reporting»: This department, which also reports directly to the CEO, was reinforced in terms of personnel and expertise. This enables operational accounting, to serve as a basis for measures to control costs, increase efficiency and generally further develop the organisation.

Establishment of the division «Marketing, Public Affairs and Sales»: This new division, headed by a member of the Executive Management, consists of the departments «Marketing, Communication and Public Affairs» and «Market Development and Sales». This reorganisation is intended to achieve in particular three goals: efficient and effective communication with all relevant target groups (FB MAKOPA); the strengthening of sales; a seamless Customer-Journey through coordination and cooperation between marketing and sales.

Creation of four «Operations» divisions: These new divisions, each headed by a member of the Executive Management, allow for a stronger industry orientation and thus the fulfilment of increasingly specific customer needs.

Establishment of the specialist department «Sustainability Services»: This new department, managed by a member of the Executive Management, enables to centrally develop and offer services in strategic business unit 2. With the same objective, the product portfolio of the subsidiary SQS Deutschland GmbH has been transferred to this specialist department.

Realignment of the D365 project: Since 2022, SQS has been working on the development of a system for enterprise resource planning (ERP) and customer relationship management (CRM) based on the Microsoft Dynamics 365 (D365) software. As there is no standard solution on the market for accredited conformity assessment bodies, SQS and its development partner Ambit Group are entering uncharted territory. In 2024, due to the growing complexity of the project, we jointly concluded that the D365 target architecture needed to be simplified. This realignment postpones the system launch from 2025 to 2026.

Although SQS is primarily known as a certification body for ISO management system standards and generates the majority of its income from this activity: the newly formulated purpose article in the Statutes of 2023 requires SQS to strengthen the business location and the performance of the Swiss economy in a comprehensive sense. The focus is on SMEs because they are more dependent on SQS services than large companies and account for more than 90 per cent of our clientele. With this in mind, we took various measures in 2024 to fulfil our role as a player in the Swiss SME economy in the interests of our members and clients:

SQS-Rendezvous: On 8 October 2024, we held the SQS Rendezvous in the Hotel Bellevue Palace in Bern for the first time, an exclusive C-level event for our member organisations. The topic was «Sustainability reporting: Rules for the Swiss economy». The objectives were:

- the exchange of information and knowledge on the market and framework conditions with strategic decision-makers from our member organisations;

- the strengthening of our reputation as a legitimate, competent and/or influential organisation with regard to the issues of «good rules for smooth markets (norms, standards and government regulation)», «market access and recognition through credible assessments and certifications» and «SMEs and sustainability (requirements, tools and empowerment)»;

- to better understand the needs and resources of our member organisations and prepare the ground for possible collaborations.

20 member organisations took part, including the umbrella organisations Economiesuisse and the Swiss Trade Association. The State Secretariat for Economic Affairs SECO was also represented. The CEOs of SQS customers Thermoplan AG and Wander AG provided a practical perspective. The positive feedback from participants and a concrete cooperation project were indicators of a successful first event.

SQS Corporate Forum: On October 16, 2024, we held the first SQS Corporate Forum, an exclusive C-level event for our clients, at The Dolder Grand in Zurich. The event was inspired by the previous year's anniversary event at the same venue. The topic was «Sustainability Reporting: Rules and Practice for Swiss Companies.» The objectives were:

- Increase/secure revenues by retaining customers at board/management level and by using customers as multipliers and for marketing activities;

- Acquire market knowledge through a targeted and structured dialogue about customer needs and market developments.

24 customers were represented by their CEO or another strategic decision-maker. Indications of a successful first implementation were: the positive feedback from participants; the continuation of the topic at the SQS Corporate Forum 2025 with the participation of several customers; the quality of the communication contents from and about the event and the response it generated (for example the blog posts Obligations for sustainability reporting: current developments, costs and benefits | SQS and Sustainable corporate governance: a map of requirements and tools | SQS).

Public Affairs: The focus of the reporting year was the consultation on the amendment to the Code of Obligations regarding transparency on sustainability aspects. SQS had been in discussions with the federal administration bodies involved since the previous year, with the result that conformity assessment bodies (CABs) were included in the draft legislation for the verification of sustainability reports - albeit under the supervision of the audit oversight authority and in accordance with the system logic of financial auditing. The central message of our statement to the Federal Council was therefore: The SME sector would benefit greatly if CABs were authorised under the supervision of the accreditation body. This would increase verification capacities and promote competition. In addition, SMEs would be given the opportunity to select the appropriate verification approach according to their resources and needs. Finally, CABs could enter into a flexible division of labour with smaller auditing companies. They could offer joint services and thus stand up to the large auditing companies. In this way, we have taken on our role as a player in the Swiss SME economy.

Monitoring and care of the certification market: Our certifications only provide their full benefit within the framework of a functioning system. In particular, this means that market participants must be informed transparently and honestly as to whether a certificate is accredited. Non-accredited certificates are legal and legitimate. However, it must be clearly communicated to the market that the issuing CAB is not checked to see whether it fulfils the high requirements of accreditation. This does not guarantee that their certificates have the quality, credibility and worldwide recognition that accredited certificates have. Based on our statutory mandate and in our role as Switzerland's leading CAB, we therefore continued to monitor the market in 2024. We pointed out misleading or even illegal practices to other CABs and informed market participants about the nature and value of accredited conformity assessment. In terms of market cultivation and quality assurance, we were also the driving force behind the so-called CB Roundtables, a loose exchange between the CEOs of accredited CABs in Switzerland.

Other relevant events and developments

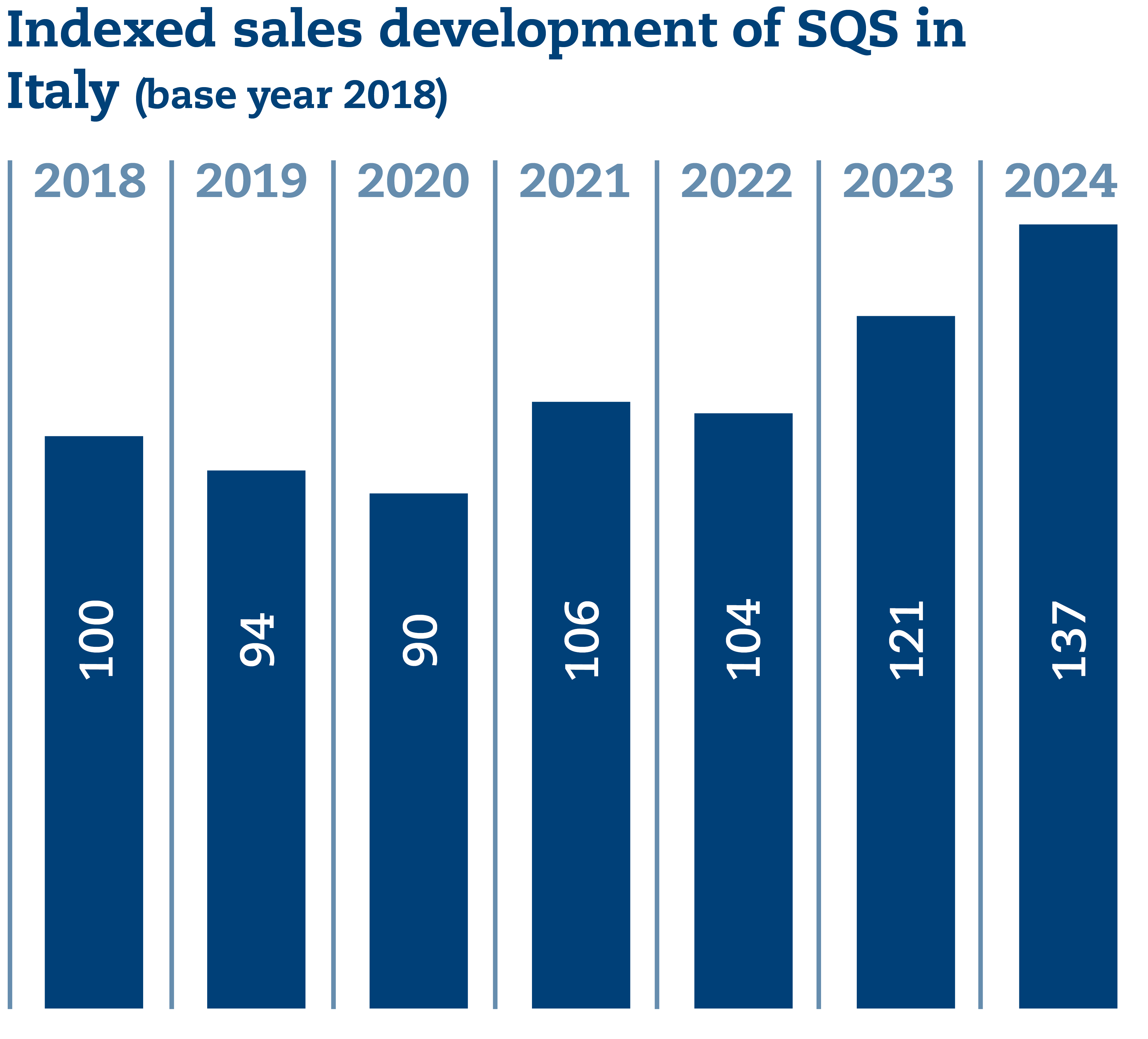

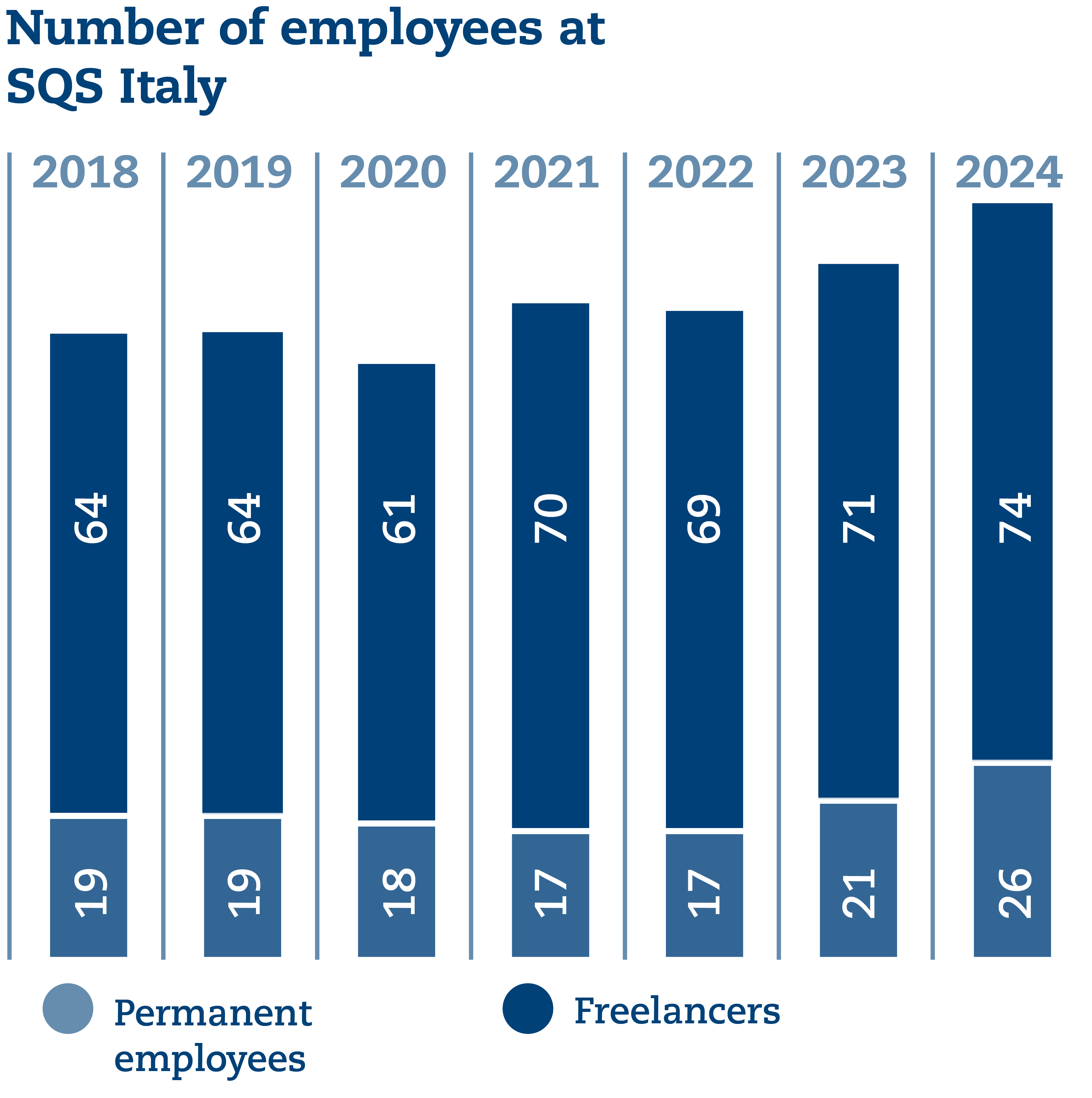

Successful first financial year for SQS Italia S.r.l.: Italy is the world's second largest market for accredited certifications. The Italian government does not enforce numerous regulatory requirements itself, but rather through CABs that are approved by the accreditation body Accredia. In order to serve this large and dynamic market even better and, for example, to obtain accreditations that are only relevant for Italy, SQS founded in 2023 SQS Italia S.r.l. based in Milan. The subsidiary began several accreditation procedures in its first full financial year and was once again able to significantly increase its turnover. It benefited from the fact that, thanks to the support of and synergies with the Swiss parent company, it can operate a very lean and efficient business model, which is based in particular on the flexible use of freelance auditors. There is a good chance that SQS Italia will continue this joint success story in Italy.

Withdrawal from the Swissmedic notification: After other CABs withdrew, SQS was the only Notified Body based in Switzerland for the certification of products and quality management systems in accordance with the Medical Devices Ordinance (MedDO) for several years. In 2024, we decided to discontinue the associated activities and let the notification by Swissmedic expire at the end of March 2025. The decision had to do with the increased and still increasing regulatory requirements. In order to fulfil these in the medium and long term, we would have had to make major investments. However, an associated growth strategy was not possible because the market environment and -potential remained characterised by important regulatory and political uncertainties in the foreseeable future. These included, in particular, the unresolved recognition of Swiss medtech certificates by the European Union. Despite withdrawing from the MepV area, we continue to certify quality management systems in accordance with ISO 13485:2016.

Restructuring of SQS Germany GmbH: The subsidiary, based in Constance, was founded in 2021 to ensure uninterrupted access to the European Single Market for Swiss companies in the context of the unresolved recognition of Swiss medtech certificates by the EU. Due to political and regulatory changes, the SQS Board decided in 2023 to discontinue the associated notification procedure in Germany. This limited the activities of the German subsidiary to the development and implementation of services in the area of sustainability. In 2024, the SQS management decided to merge the sustainability products of the parent company and the German subsidiary into one portfolio as of 1 January 2025 (see this press release), which will be managed by the new specialist division from Switzerland. This should facilitate customer- and needs-specific market development on the one hand and enable synergies on the other. Internal and external follow-up solutions have been found for the affected employees of SQS Deutschland GmbH.